“If it ain’t broken don’t fix it” is a common sentiment in the financial industry.

“If it ain’t broken don’t fix it” is a common sentiment in the financial industry.

But to afficionados of the FIX message protocol, the process of matching trade details is broken, so it needs solutions

Providers of order management systems think they are just the right folks to fix the problem — the so-called monopoly enjoyed by post-trade communications provider Omgeo to centrally match the details of securities transactions between fund managers and broker-dealers through Omgeo’s Central Trade Manager (CTM).

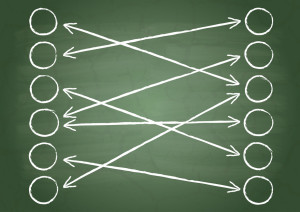

Although global financial-messaging giant SWIFT has also begun allowing fund managers and broker-dealers to locally match their trades through its network, members of the FIX Trading Community, the trade group that develops and promotes the FIX message protocol for trade execution, apparently don’t see SWIFT as a serious competitor. The reason: they claim it will be hard to persuade fund managers and broker-dealers to rely on a message system and network that has been historically focused on back-office settlement. SWIFT has given its service a fancy name –Global Electronic Trade Confirmation, or GETC — but it is not a dedicated platform. It’s simply a bunch of messages which can be transported through its network.

The latest salvo in the emerging battle between Omgeo and the FIX Trading Community to win the hearts — and operational choice — of fund management firms: front-end order management heavyweight Fidessa has just announced a turnkey standalone direct affirmation application based on the FIX matching protocol and workflow.

“Fund managers using the Fidessa order management system or any competitor’s can easily link the platform to the Fidessa affirmation application to locally match their trade details with broker-dealers,” explains David Pearson, strategic business architect at Fidessa and co-chair of the FIX Trading Community’s post-trade working group. “Our goal is to offer an alternative to Omgeo so firms don’t feel compelled to use the CTM if they don’t want to.”

Just how did Omgeo get its dominant role in the post-trade matching game? The subsidiary of US Depository Trust & Clearing Corp.says that it offers the most efficient matching process which will help ensure that trades are affirmed on the day they are executed. All fund managers and broker-dealers have to do is insert their understanding of trade details in the CTM concurrently and presto the trade is either matched or rejected for further processing. By contrast, local matching relies on a more cumbersome sequential confirmation-affirmation process. As European markets migrate to a two-day settlement timetable in October and the US eventually following suit, Omgeo claims that fund managers will want — if not need — to rely on the speed and efficiency of a central matching process.

But that isn’t the entire story of how Omgeo built its massive client base for matching services. After all, Omgeo did compel all users of its Oasys Global confirmation system to migrate to the CTM matching system as of June 2013. They didn’t have any choice if they wanted to remain Omgeo customers. Of course, Omgeo has won new customers. Of more than 1,700 firms now using the CTM, more than 150 broker dealers and 250 investment managers signed up in 2013.

Post-Trade Our Way

Fidessa’s Pearson doesn’t seem to be fazed by Omgeo’s marketshare. Neither does Ignatius John, president of Alpha Omega Financial Systems, the San Francisco-headquartered post-trade technology specialist. Last year, Alpha Omega teamed up with Fidessa rival Linedata to integrate Linedata’s order management system with Alpha Omega’s FIXaffirm engine. The value proposition is similar to that offered by Fidessa, with the exception that the Boston-based Linedata is relying on an external partner rather than internal resources.

“We’re not trying to displace Omgeo,” insists John, echoing Pearson’s position. “We just want to offer clients on the buyside and sellside a more efficient, cost-effective alternative to Omgeo’s CTM, and are happy other order management system providers are also rising to the occasion.”

Just why do Fidessa and Linedata claim their “alternatives” to be more efficient? The answer appears to be an operational advantage offered by extending the use of FIX Protocal messaging farther down the transaction lifecycle. “It [Fidessa’s application] follows the natural workflow from trade execution to post-trade matching relying on the same well-established protocol,” claims Pearson. “It doesn’t require any extra integration work.”

Of course, practically speaking, that particular benefit might apply only to the 70 fund managers using Fidessa’s OMS. While those using an alternative OMS might still operationally profit from tying to Fidessa’s affirmation platform, they would need to expend some IT effort to move information from an unrelated OMS to Fidessa’s affirmation application.

Who Will Use It?

And what about fund manager customers of Fidessa or Linedata OMS systems who already are using the CTM? It’s a no-brainer, according to John. “Those already using one of the two order management systems — Fidessa or Linedata — can add on their post-trade applications or replace the CTM with one of them,” he says, while declining to specify how many clients of Linedata’s OMS are using Alpha Omega’s FIXaffirm engine.

It stands to reason that, since the world’s largest broker-dealers are already FIX-enabled when it comes to trade execution, they might just be happy to work with fund managers who use FIX for post-trade matching as well. Yet another reason: cost savings. However, without a specific apples-to-apples comparison it’s hard to make a comparative pricing analysis between using the FIX protocol through an OMS and Omgeo’s CTM. Neither Pearson nor John would provide one. Omgeo officials also say it is impossible to compare “dissimilar” services.

John does acknowledge that SWIFT’s GETC is showing some traction in Europe, but that’s only because fund managers are trying to find a quick alternative to Omgeo, he says. “They are very enthusiastic when shown the potential to expand the use of the FIX protocol.”

Just what do fund managers think of all the commotion? One operations manager at a New York fund management firm says fund managers that are heavily reliant on a paper-based or internal electronic matching system might consider relying on the FIX protocol if it came in a turnkey solution. “It’s a quick fix to an inefficient process,” he tells FinOps Report. However, asset management shops using the CTM will likely think long and hard before scrapping their existing provider. “They might claim to want choice, but the operational process isn’t broken,” he says. A more likely option: adding on FIX local matching functionality in addition to central matching.

Omgeo Response

Just what do SWIFT and Omgeo make of all the noise? SWIFT officials were unavailable for comment. Omgeo executives are circumspect about criticizing the potential competition, but they don’t seem to be taking it all that seriously.

“Omgeo CTM provides an integrated trade management solution which solves issues of connectivity, messaging, support, disaster recovery, matching, exception management and settlement instruction enrichment in a timely and auditable fashion,” says Matt Nelson, Omgeo director of strategy. “Omgeo CTM clients don’t need to manage bilateral connections to their counterparties, manage version changes to messaging protocols or pay large license fees and recurring maintenance costs for local matching software, among many other overlooked costs.” What’s more, Omgeo also provides pricing incentives for same-day affirmation through the CTM.

As for streamlining the post-trade workflow process, Omgeo can certainly hold its own. “We partner with many of the world’s leading OMS providers today allowing firms to leverage existing front-office systems, some of which leverage the FIX protocol in the front office, to access the best practice central matching capabilities of the CTM in the middle office,” says Nelson. Case in point: Omgeo has has teamed up with Eze Software Group to launch an interface to fully automate matching of futures and options trades between Eze’s OMS and the CTM.

With two major providers of OMS platforms, each with its own customer base, bringing the new FIX Protocol for matching into commercial reality, the question of whether it offers real advantages over Omgeo’s CTM will now start to be answered by the marketplace. With Omgeo’s current headstart, it may be some time until FIX Protocol takes a noticeable bite out of Omgeo’s domestic and global marketshare, assuming it ever does. Omgeo certainly has the numbers now, but FIX Protocol has the presence in trade execution. The fact that neither side seems too worried about the other may be a temporary situation. Stay tuned.

Leave a Comment

You must be logged in to post a comment.